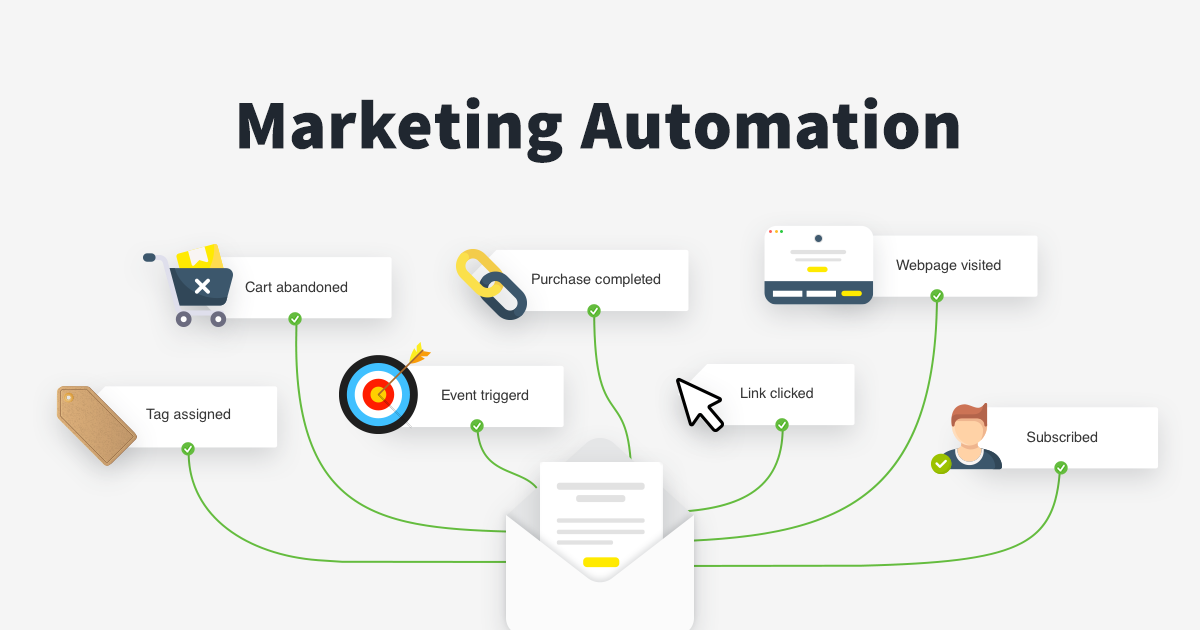

Automation marketing is a type of marketing that uses automation tools to create and send automated messages to customers. These messages can be based on customer data or past interactions with the company. They can also be triggered by changes in customer behavior or market conditions.

Automatisation marketing is a type of marketing that uses automation tools to create and send automated messages to customers. You can Check out this link, If you want to know more about how to Automatisation Marketing work.

Image Source:Google

These messages can be based on customer data or past interactions with the company. They can also be triggered by changes in customer behavior or market conditions.

Automation Marketing for Sales Automation marketing for sales is a type of marketing that uses automation tools to create and send automated messages to customers. These messages can be based on customer data or past interactions with the company.

They can also be triggered by changes in customer behavior or market conditions. Automatisation marketing for sales is a type of marketing that uses automation tools to create and send automated messages to customers.

These messages can be based on customer data or past interactions with the company. They can also be triggered by changes in customer behavior or market conditions. This type of marketing is common in the automotive industry as it helps companies to be more efficient and offer customers a behavior experience.

For example, dealers can send automated messages to current or potential customers that they are in the area and remind them to schedule service appointments.