Crowdfunding has become a popular way to raise money for projects, often through platforms like Kickstarter and Indiegogo. Crowdestor is a comprehensive review of the best crowdfunding platforms available so you can make the right decision for your next project.

Crowdestor is a comprehensive platform that allows users to raise money for a wide variety of projects. You can also read the reviews on Crowdestor at Crowdfunding Platforms website. Crowdestor is one of the most popular platforms for crowdfunding, and has been used to raise money for a variety of projects.

It is easy to use and provides many features that make managing your project easier. Crowdestor's reputation for safety and security is also noteworthy, making it an ideal choice for crowdfunded investments. Crowdestor is a comprehensive platform for crowdfunding.

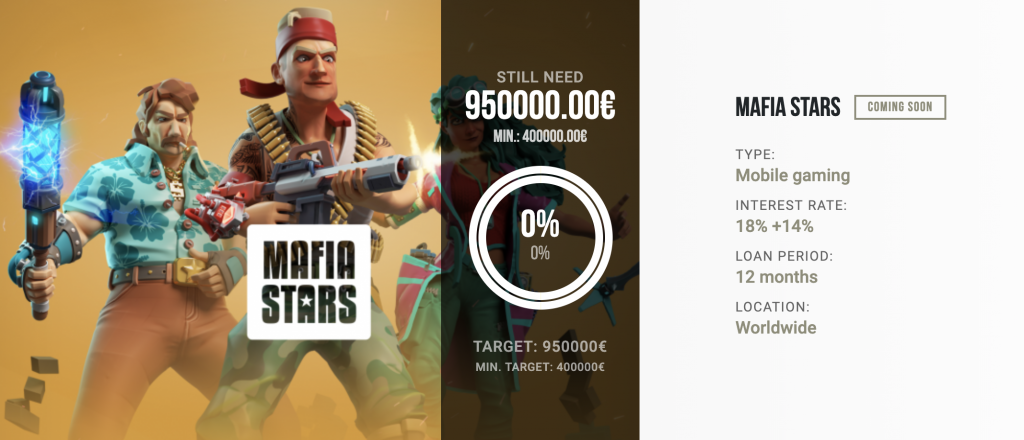

It provides users with access to a wide range of crowdfunding tools and resources, including an investment section and a variety of fundraising options. Crowdestor also has an excellent user interface that makes it easy to find the information you need and navigate through the site. The platform offers detailed information on each project, including a video overview and information on the project’s rewards.

Crowdestor also features social media integration, so you can share projects with your friends and followers easily. You can also use Crowdestor to help promote your own campaigns, or to pledge money to a project you are interested in. Overall, Crowdestor is an excellent platform for both investors and campaigners alike. Crowdestor is a comprehensive crowdfunding platform that allows users to manage and fund their projects easily.