A high-risk merchant account is a merchant account or payment processing agreement that is tailored to fit a business that is deemed high risk or is operating in an industry that has been deemed as such.

These merchants usually need to pay higher fees for merchant services, which can add to their cost of business, affecting profitability and ROI, especially for companies that were re-classified as a high-risk industry, and were not prepared to deal with the costs of operating as a high-risk merchant.

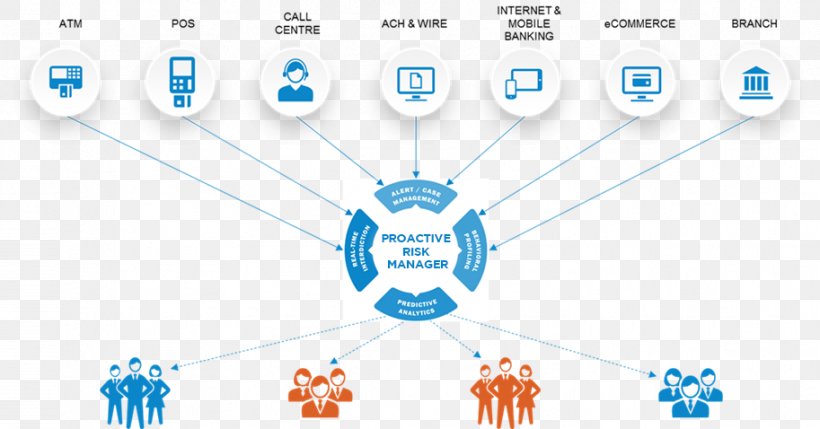

You can check this out for more info about risk management in merchant account.

Some companies specialize in working specifically with high-risk merchants by offering competitive rates, faster payouts, and/or lower reserve rates, all of which are designed to attract companies that are having difficulty finding a place to do business.

Businesses in a variety of industries are labeled as 'high risk' due to the nature of their industry, the method in which they operate, or a variety of other factors.

For instance, all adult businesses are considered to be high-risk operations, as are travel agencies, auto rentals, collections agencies, legal offline and online bail bonds, and a variety of other online and offline businesses. Because working with, and processing payments for, these companies can carry higher risks for banks and financial institutions they are obliged to sign up for a high-risk merchant account that has a different fee schedule than regular merchant accounts.

A merchant account is a bank account but functions more like a line of credit that allows a company or individual (the merchant) to receive payments from credit and debit cards, used by the consumers.