Peer-to-peer loans (P2P) have evolved into a very good method for debt financing. This has enabled loan seekers and loan providers to borrow or lend money by eliminating intermediary financial institutions. By effectively bridging inadequate gaps from sufficient formal credit, it offers a platform where investors can provide adequate funds to borrowers without conventional banking system interventions.

In addition, this process involves a faster process for the loan and provides the best peer to peer lending companies via https://crowdfunding-platforms.com/ and gives approval in a shorter time span and with little effort rather than the main current loan scenario. Fortunately, the overall response to this platform has been encouraging.

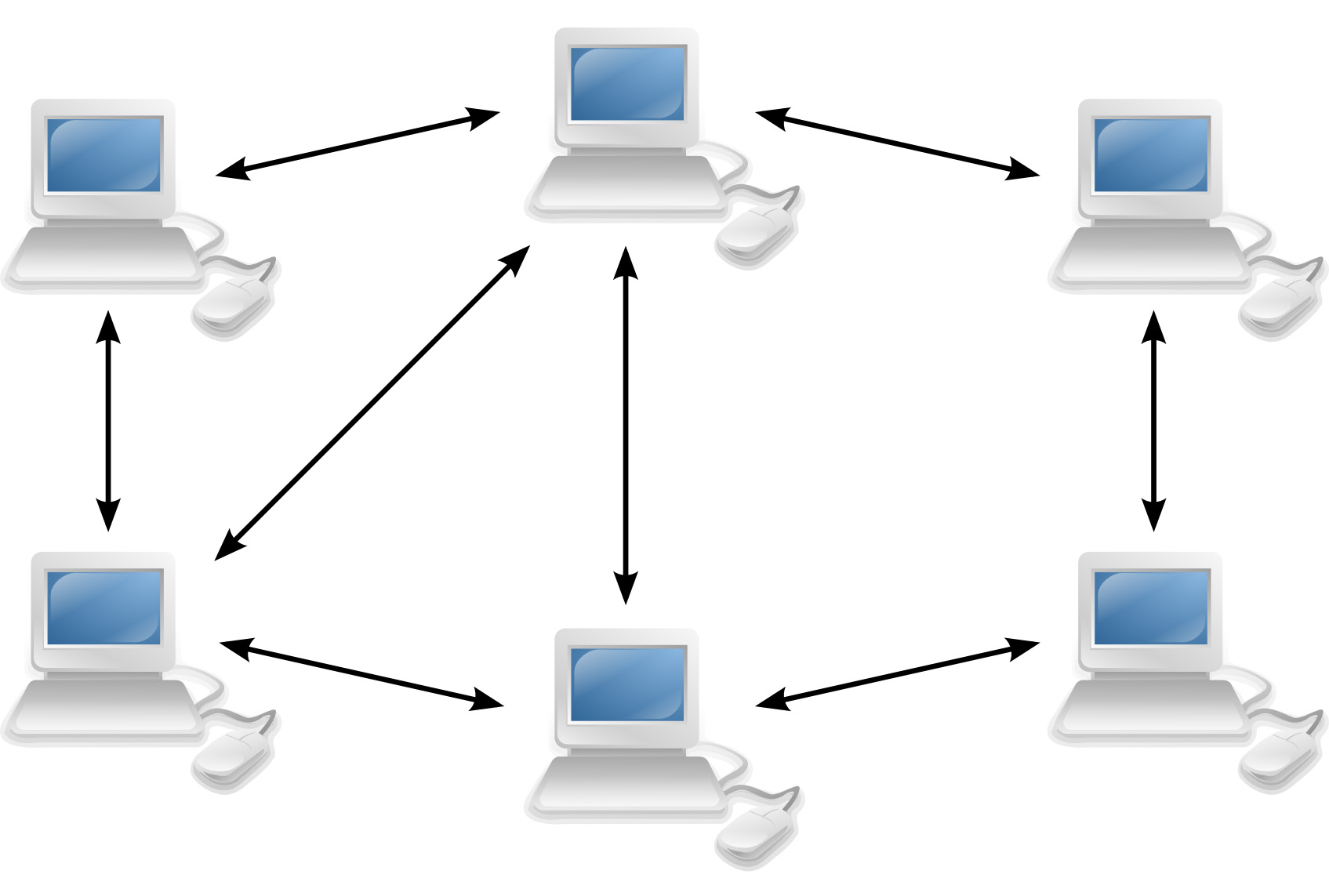

Image Source: Google

Why consider peer-to-peer loans

In the past few years, a variety of well-known loan providers for debt financing methods have appeared globally. This lender has eliminated the need to have an intermediary from the process of loans and traditional loans. These include:

• Loans are less complex and very affordable

• Investment is quite profitable and smooth

Peer-to-peer trends and growth!

This loan market is directed for massive growth in the near future. Before becoming a global and we began to pay attention to the increase in various new markets that kicked in, let's dig deeper to understand some of the fundamental trends that would form this surging industry. There is a large scope for cross-country investment opportunities.